how to declare income tax

These amounts are set by the government before the tax filing season and generally increase for inflation each year. From 6 April 2020 Income Tax relief on all residential property finance costs is restricted to the basic rate of.

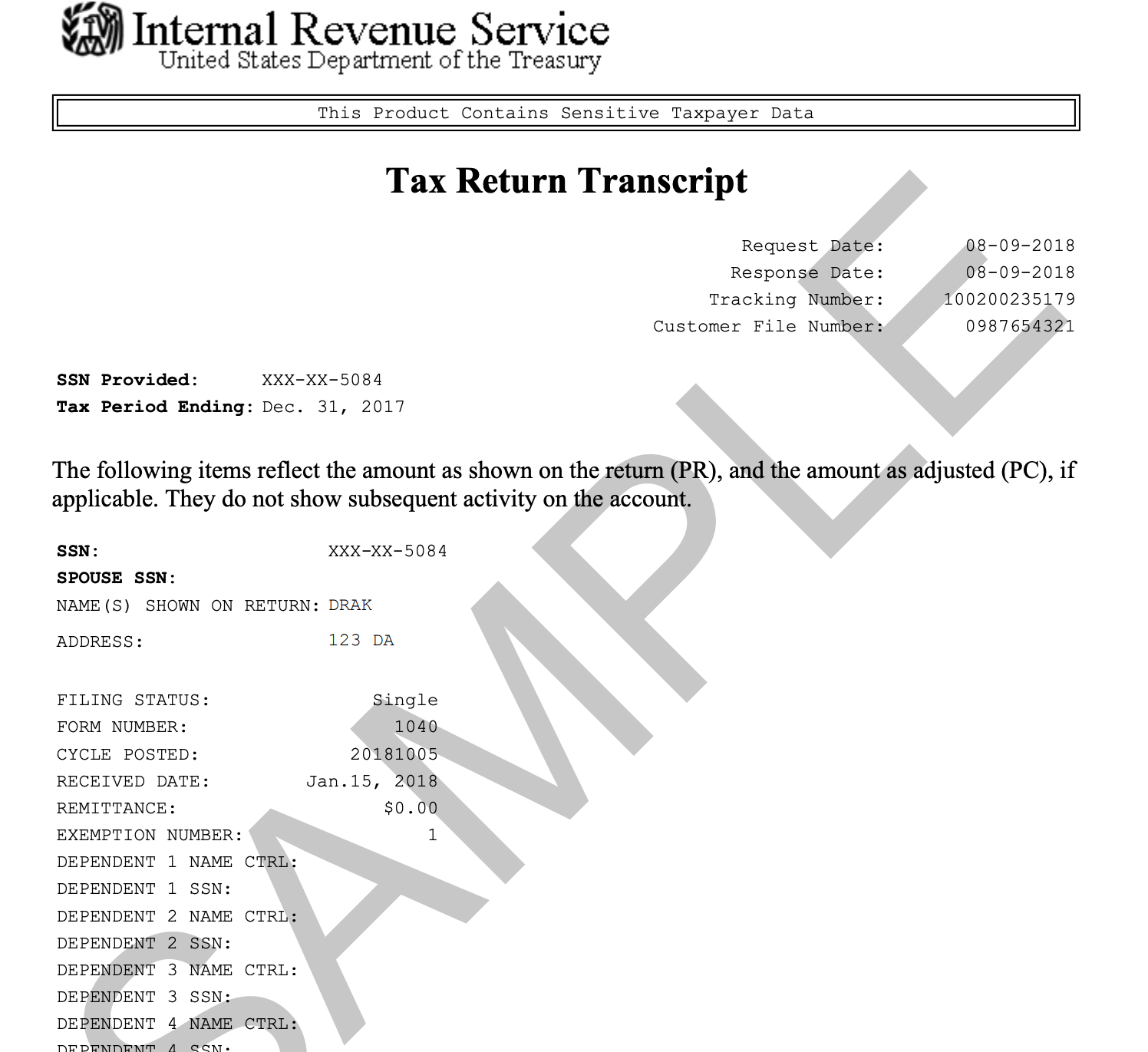

Federal Income Tax Filing Resident Office Of International Students Scholars

Click on Review your tax link in PAYE Services.

. This could push your total income into the higher or additional-rate tax brackets depending on your income from other sources such as your salary or pension. You must declare hobby income The IRS wants you to declare all your hobby income even if its a small amount of money. If your hobby or side business has a net profit you have to pay income taxes on that net profit even with the new tax law says Irene Wachsler a CPA at Tobolsky Wachsler CPAs LLC in Canton Massachusetts.

One time withdrawal from pension or retirement account is non-recurring lump sum and does not count as income. The standard tax deduction amounts that youre eligible for are primarily determined by your age and filing status. Additional training or testing may be required in CA OR and.

The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in Oregon. Additional time commitments outside of class including homework will vary by student. Mortgage interest tax relief in 2022.

Your company is taxed at a flat rate of 17 of its chargeable income. The Volunteer Income Tax Assistance VITA program offers free tax help to people who generally make 58000 or less persons with disabilities and limited-English-speaking taxpayers who need help preparing their own tax returns. The tax exemption scheme for new start-up companies and partial tax exemption scheme for companies are tax reliefs available to reduce companies tax bills.

Just upload your form 16 claim your deductions and get your acknowledgment number online. If you jointly own property with your spouse or civil partner and want to change the split of income from it for tax purposes use Income Tax form 17. The total amount is referred to as assessable income or total income.

Consider your gross income thresholds. Notifying Beneficiaries to Declare Share of Income. For example if you receive a check but dont cash it by the end of the tax year it is still considered income for the year you received the check.

See our definitions for explanations of tax and super terms that you dont understand. You both need to declare beneficial interests in joint property and income. Assuming a landlord takes in 950 per month rental income and makes mortgage interest payments of 600 per month.

HM Revenue Customs. Hotline QA Feb 2014 Quarterly clothing allowance for foster children paid by DCF is countable unearned income Transitions Hotline Sept 2014 State and federal income tax refunds are nonrecurring lump sums and are non-countable as. If you are carrying on a business most income you receive is assessable for income tax purposes.

Distributing Income to Non-Resident Beneficiaries. Efiling Income Tax ReturnsITR is made easy with Clear platform. If your net rental income is over 5000 you will have to register for self assessment.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. In the Non-PAYE Income page select Other Income and add Rental Income complete and submit the form. Select the Income Tax Return for the year you wish to claim for.

But you can also pay tax on income not yet in your bank account. Further you can also file TDS returns. Youll need to fill in a separate tax return.

Include a copy of your 2020 federal return and schedules. Income taxes are the most significant form of taxation in Australia and collected by the federal government through the Australian Taxation OfficeAustralian GST revenue is collected by the Federal government and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission. Australia maintains a relatively low tax burden in.

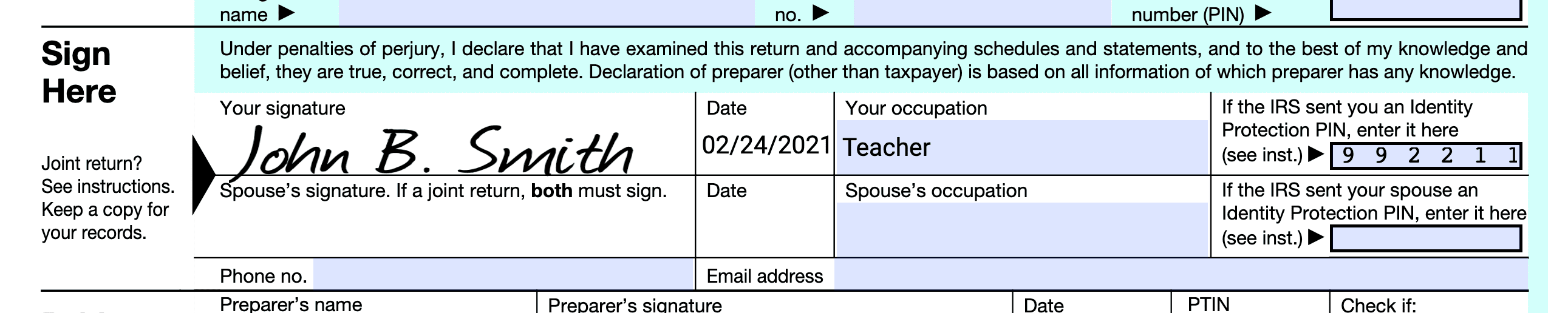

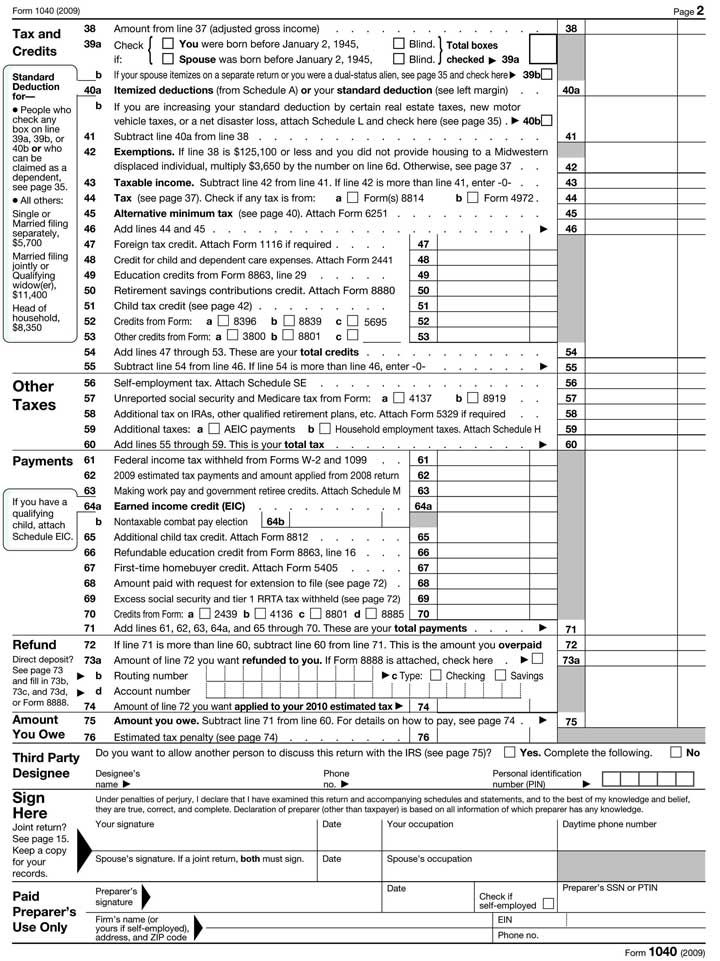

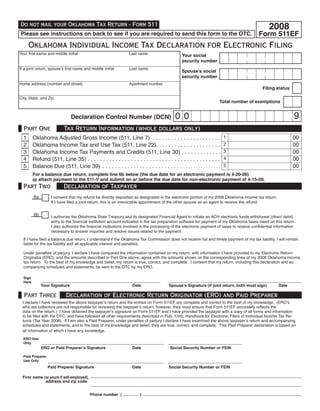

Theyll pay tax on. Most taxpayers are eligible to take the standard deduction. I declare that this return is correct and complete to the best of my knowledge and belief.

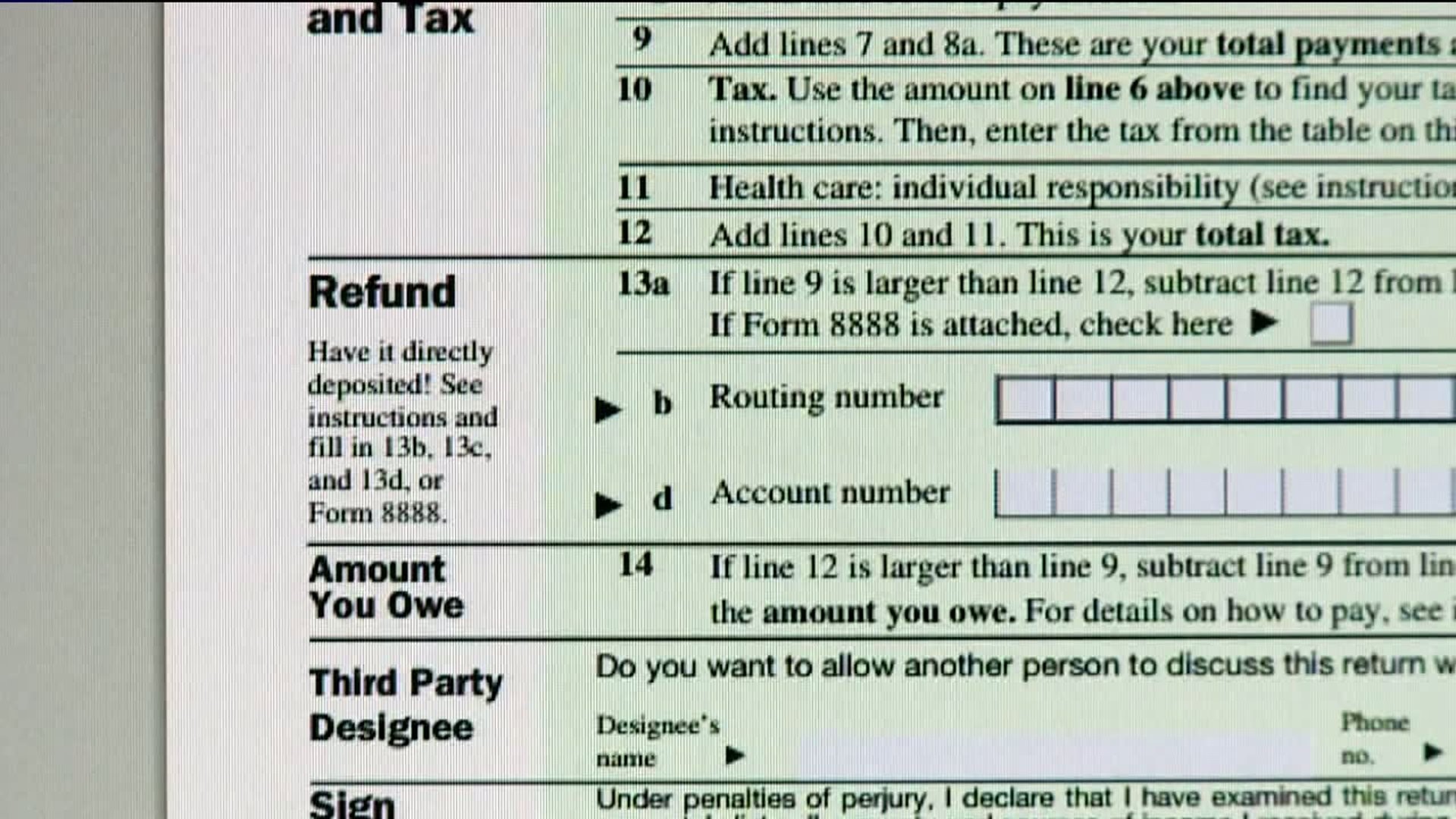

However your accounting method may affect which amounts must be included in an income year. If you do not usually send a tax return you can register for Self Assessment to declare any income you have not paid tax on from the last 4 years. The IRS requires that you declare all income on your return.

The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are. Paul MN 55145-0010 I authorize the Minnesota Department of Revenue to discuss this return with my paid preparer or the third-party designee. Minnesota Individual Income Tax St.

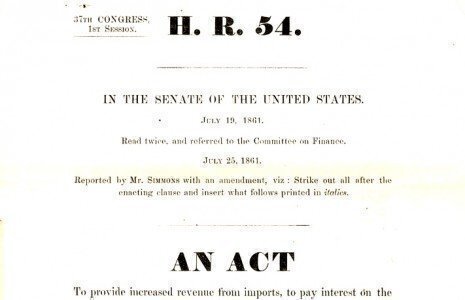

Blame Abraham Lincoln For The Nation S First National Income Tax The National Constitution Center

Mailing A Tax Return To The Irs Or Your State

Do I Need To File A Tax Return Forbes Advisor

City Of Easton Income Tax Filing Deadline Extended Until 5 17 Easton Pa

Do Nris Need To Disclose Foreign Account Details In Tax Returns Sbnri

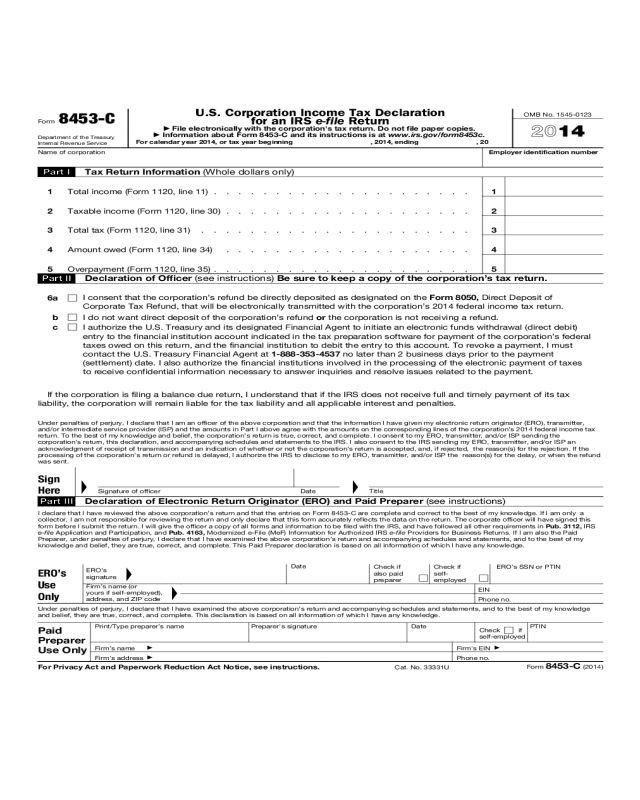

U S Corporation Income Tax Declaration For An Irs E File Return Edit Fill Sign Online Handypdf

The U S Federal Income Tax Process

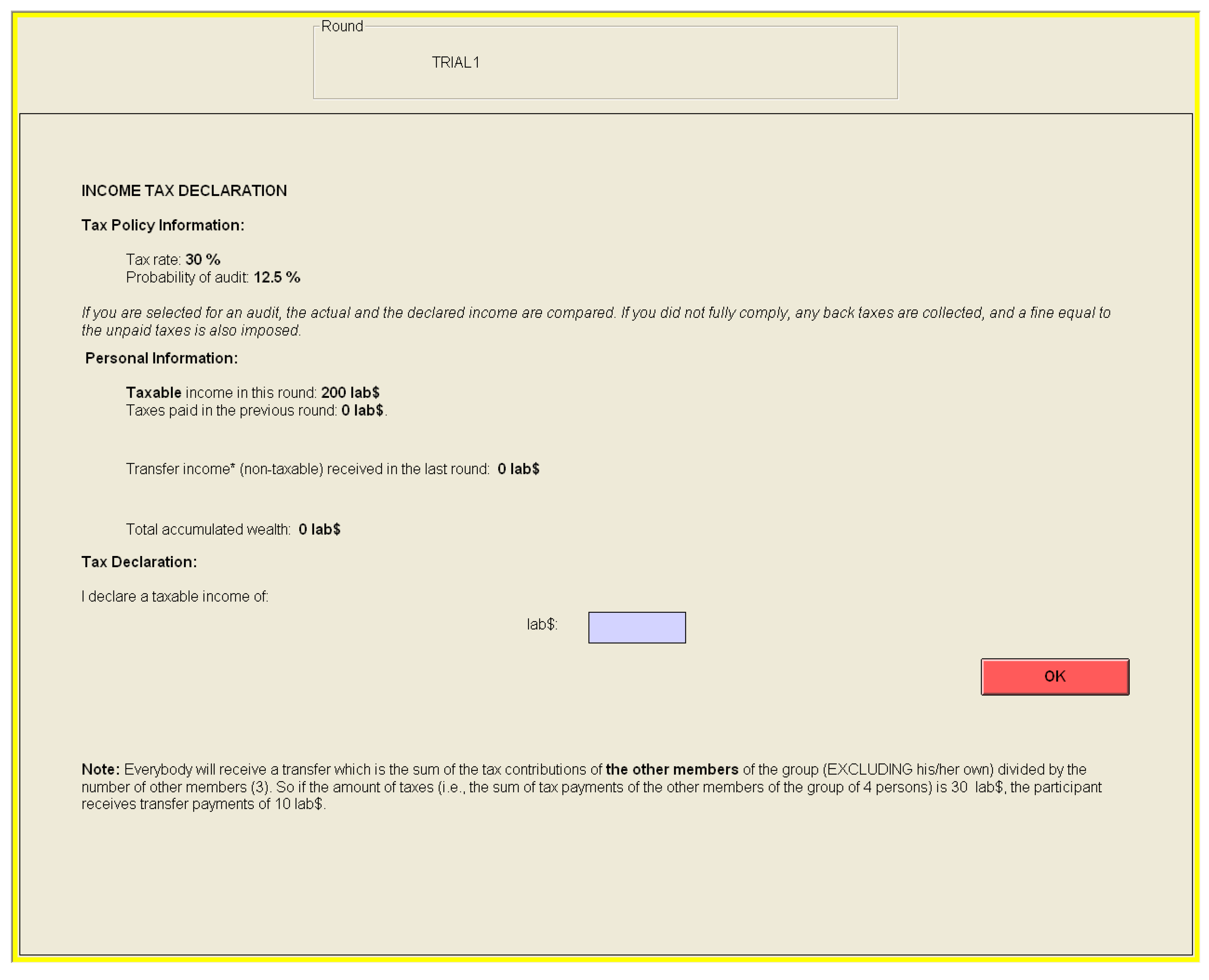

Games Free Full Text Response Times And Tax Compliance Html

How To File An Income Tax Return In Spain Expatica

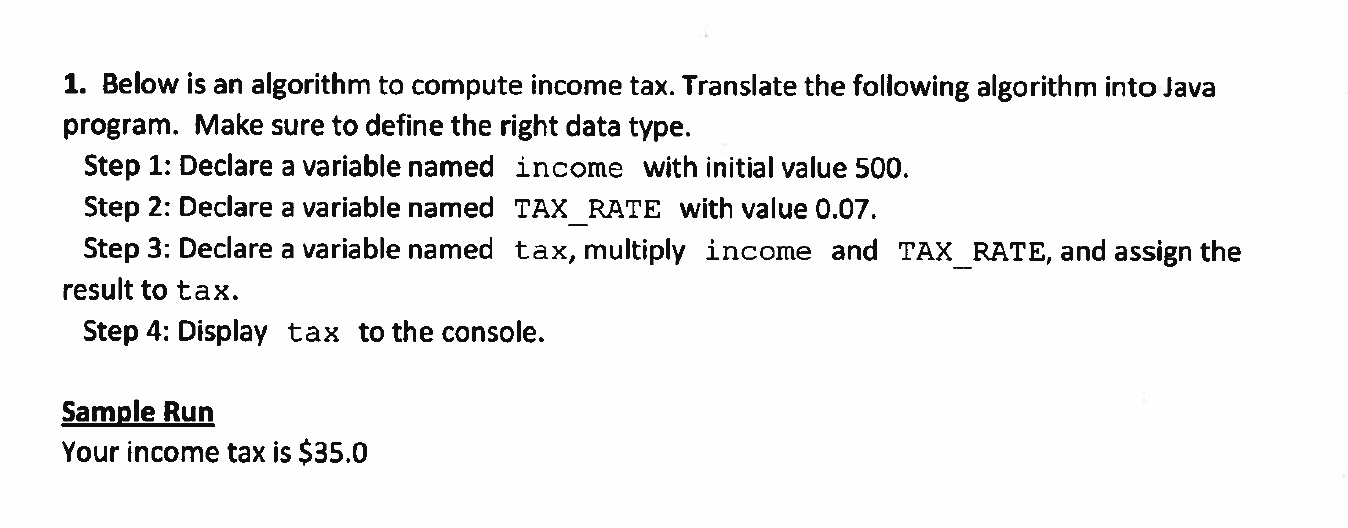

Solved 1 Below Is An Algorithm To Compute Income Tax Chegg Com

U S Permanent Residents And Citizens Must Declare And Pay U S Taxes On Worldwide Income U S Green Card Reentry Permits

Tax Documents Needed For Marriage Green Card Application

Taxation In The United States Wikipedia

How To File A Zero Income Tax Return 11 Steps With Pictures

Pennsylvania Personal Income Tax Returns Deadline Extended Wnep Com

Do You Have To File Taxes If You Make Less Than 1000

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Comments

Post a Comment